Thermal Paper Industry: On Overcoming COVID-19

The future of the thermal paper industry looks bleak in the face of COVID-19. Or is it really?

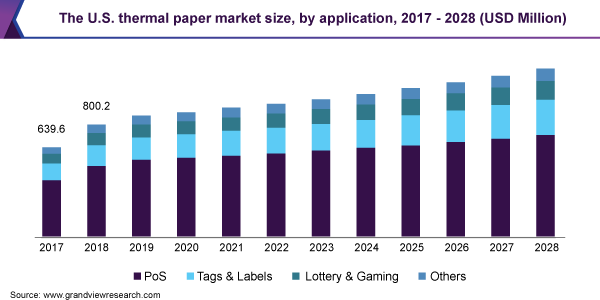

Digital receipts as a disruptor, and now COVID-19. Blow after blow, the thermal paper industry in the US is seeing a decline in demand from 280,000 metric tons in 2019 to 252,000 metric tons in 2020[1]. Meanwhile, pre-pandemic market research indicates a healthy growth of compounded annual growth rate (CAGR) of 4.8% from 2020 to 2027[2]. Which way is up (or down)?

Exceptional times call for exceptional measures. Regardless of the numbers, what matters is acknowledging that conventional methods or products are no longer working and one should pivot creatively to meet customers’ evolving needs.

Strategically identifying trends and potential solutions

Addressing new market segments

Added value through innovation

Cost-effective long-term partnerships

Addressing new market segments

—

While it may be true that the addressable market space in the US, China, and India is adversely impacted by covid-19[3], it does not necessarily spell catastrophe for suppliers, distributors, or wholesalers of thermal paper.

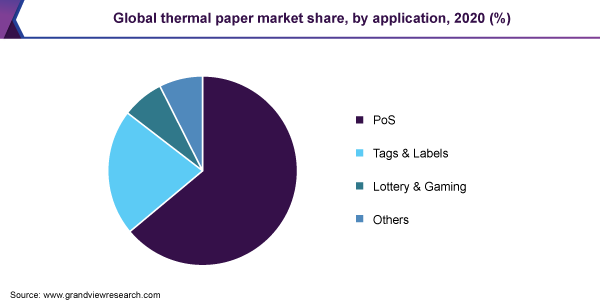

With a little ingenuity, they can maximize and increase market share by tapping into alternative usage of thermal paper. As market research indicates, point of sales (POS) applications account for the larger slice of the pie[4].

Instead of the singular, traditional focus on retail, there are other applications that are pandemic-proof such as the usage of thermal paper in medical (hospital billing), warehousing, government facilities, etc. In fact, despite the effect of COVID-19 on traditional brick & mortar businesses – online food delivery sees an increase in demand, up to 21%[5] and they will need to utilize the use of paper receipts considering the fact that 73% of Americans prefer getting paper receipts [6] due to privacy concerns of e-receipts.

Adding value through innovation

—

In an article by McKinsey regarding graphic paper producers, diversification opportunities through innovative product development may help boost margins by 1-2%[7]. Being in the paper industry, thermal paper markets could share the same sentiments. How exactly?

With thermal paper roll annual consumption in the US of more than 2.5 billion, one can expect an estimated 22,046 tons of plastic cores contributing to landfill. By going coreless, one can make that much of a difference in reducing carbon footprint. Apart from going green which customers applaud, there is also a monetary incentive to going coreless, as much as USD 2,200/FCL when one opts to do away with the core.

Other ways to innovate may include the use of high-quality, attractive receipts instead of traditional homogenous blank receipts. Apart from auditing purposes, pre-printed receipts allow for branding and advertising opportunities while reducing cases of fraud. Such applications increase the perceived value pricing of pre-printed rolls and hence allowing distributors to increase their top line.

Cost-effective long-term partnerships

—

Albeit more qualitative – long-term partnerships with the right thermal paper manufacturer/converter may be the other solution to weathering the COVID-19 storm. While shopping around for the lowest-priced manufacturer comes to mind, that’s not what “cost-effective” necessarily means.

As any astute businessperson would know, there are a multitude of hidden costs such as logistics, opportunity costs, impacts of regulation, leverage, etc. Even a change such as exploring international markets can be an advantage of 10-15% increase in volume[8]. The right thermal paper partner who has the ability to consult on these aspects can be the difference between success and failure.

As such, despite it all, COVID-19 is not the be-all and end-all certainty of doom for the thermal paper industry. With the advent of new successful clinical trials of vaccines comes light at the end of the tunnel. Meanwhile, keep your chins up and keep (the thermal paper) rolling with these contrarian approaches above.

[1] CVS Moves to Digital, Non-Toxic Sales Receipts, Packaging Strategies; https://www.packagingstrategies.com/articles/95729-cvs-moves-to-digital-non-toxic-sales-receipts

[2] Thermal Paper Market Size, Share & Trends Analysis Report By Application (PoS, Tags & Labels, Lottery & Gaming), By Region (Asia Pacific, North America, MEA), And Segment Forecasts, 2021 – 2028, Grand View Research; https://www.grandviewresearch.com/industry-analysis/thermal-paper-market

[3]COVID-19 Outbreak Impact on Thermal Paper Market, Market Research Future; https://www.marketresearchfuture.com/report/covid-19-impact-thermal-paper-market

[4]Thermal Paper Market Size, Share & Trends Analysis Report By Application (PoS, Tags & Labels, Lottery & Gaming), By Region (Asia Pacific, North America, MEA), And Segment Forecasts, 2021 – 2028, Grand View Research; https://www.grandviewresearch.com/industry-analysis/thermal-paper-market

[5] Change in online food delivery penetration share of the restaurant market in the United States due to the coronavirus pandemic from 2020 to 2025, S.Lock; https://www.statista.com/statistics/1170614/online-food-delivery-share-us-coronavirus/

[6] Paper or paperless receipts: Should we say so long to long receipts and go digital?, K. Tyko; https://www.usatoday.com/story/money/2019/11/25/receipts-101-digital-receipts-grow-popularity-but-paper-still-king/4180900002/

[7] Graphic-paper producers: Boosting resilience amid the COVID-19 crisis, A. Goel, F. Grünewald, O. Lingqvist, G. Vainberg; https://www.mckinsey.com/industries/paper-forest-products-and-packaging/our-insights/graphic-paper-producers-boosting-resilience-amid-the-covid-19-crisis

[8] Graphic-paper producers: Boosting resilience amid the COVID-19 crisis, A. Goel, F. Grünewald, O. Lingqvist, G. Vainberg; https://www.mckinsey.com/industries/paper-forest-products-and-packaging/our-insights/graphic-paper-producers-boosting-resilience-amid-the-covid-19-crisis